Saudi Arabia's Foreign Policy: a Global Plea for Regional Stability

Saudi foreign policy has become increasingly multipolar in recent years. This shift isn't necessarily bad news for Washington amid rising regional tensions.

Vision 2030’s NEOM Line City is Saudi Arabia’s most ambitious and costliest project to date. Image source

Saudi Arabia has laid out an ambitious plan to revitalize the Kingdom and reduce its dependence on oil exports. Vision 2030 is vast in scope, including hundreds of billions of dollars in urban revitalization, resorts, sports and entertainment, parks, and metro lines. Its most ambitious project - the NEOM Line – is a planned zero-emissions city comprised of two mirrored skyscrapers stretching 170 kilometers across the Arabian desert to the Red Sea. This plan, combined with other strategic realities, has resulted in Riyadh's most profound strategic shift in decades, with the Kingdom drawing closer to Iran and taking a more balanced approach to East-West tensions. This shift may also offer a means to bring greater stability to the Middle East.

Mixed messages from Washington

At the start of this decade, Saudi Arabia was a steadfast partner to Washington in the Middle East, fighting a sustained war against an Iranian proxy in Yemen while on the path to normalized relations with Israel through the Trump-led Abraham Accords process. However, Riyadh has shifted in its outlook amid many new factors.

Starting in April 2015, Saudi Arabia led a coalition against Iran-backed Houthi forces in Yemen with substantial support from Washington in the form of weapons, training, and logistical support. However, upon entering the White House in January 2021, the Biden administration announced plans to cease support for the Saudi-led war effort. Biden's stance on Riyadh came not only in response to the severe humanitarian crisis in Yemen but also to the October 2018 killing of Washington Post journalist Jamaal Khashoggi. In 2019, then-candidate Biden vowed to make human rights a cornerstone of his administration's foreign policy and to turn Saudi Arabia into "the pariah that they are" during a campaign debate, setting a harsh tone for relations between the two countries.

Since Biden's decidedly tougher stance toward the Kingdom, hostilities between Saudi coalition forces and the Houthis have ceased following a March 2022 UN-brokered truce. The two sides also engaged in talks last September, and the Saudis have been much less cooperative with Washington on the Houthi issue. When the United States asked to use Saudi territories to strike at the Houthis earlier this year, Riyadh rebuffed them. Although the Biden administration has softened its stance toward the Kingdom, relations remain mercurial. For example, in October 2022, the president vowed 'consequences' for Riyadh's refusal to increase oil production, only to backtrack from this claim in February 2023.

On August 9, the Biden administration announced the lifting of its ban on offensive weapons sales to Saudi Arabia in response to the Kingdom's efforts to "substantially improve their civilian harm mitigation processes." However, it seems highly unlikely that Riyadh will resume strikes on the Houthis at this time, given all that has happened in Gaza and elsewhere in the Middle East.

Saudi Defense Minister Prince Khalid bin Salman (right) meets with a Houthi delegation in Riyadh on September 19, 2023. Image source

The war in Gaza and the unifying Palestinian cause

Israel's ongoing war in Gaza has dramatically changed Saudi Arabia's regional outlook. Even prior to the war in Gaza, moves toward normalized relations with Israel under the Abraham Accords posed a significant challenge to the regime's image due to public sympathy for the Palestinian cause. After the war commenced last October, 96% of Saudis agreed that "Arab countries should immediately break all diplomatic, political, economic, and other contacts with Israel, in protest of its military action in Gaza," according to a December 2023 survey.

"The Saudi leadership has to contend with public opinion at home," said Giorgio Cafiero, CEO of Gulf State Analytics, a geopolitical risk consulting firm. "Saudi Arabia's leadership is also aware of the fact that Riyadh normalizing with Israel would play into Iranian propaganda, and that is also a factor that officials in Riyadh take into consideration," he added. According to Mr. Cafiero, the war in Gaza has effectively shut the door on any normalization of relations between Saudi Arabia and Israel, at least for now. "I would not go as far as saying that there is no chance of Saudi Arabia normalizing with Israel one day down the road. But within the context of Israel's war on Gaza, I do not see any chance of Saudi Arabia entering the Abraham Accords".

Public sympathy for the Palestinian cause has also likely influenced the Kingdom's stance toward the Houthis, once the target of a protracted Saudi-led military campaign that claimed the lives of some 250,000 Yemenis. With the Houthis now waging an extensive campaign on the Red Sea in support of the Palestinian cause, it is political poison for the leadership in Riyadh or any other Arab capital to publicly support a campaign against them. This shift in outlook toward Yemen has also created a more secure footing for Saudi Arabia to engage with the Houthis' Iranian backers.

A shaky balance between the Kingdom and Tehran

In March 2023, Iran and Saudi Arabia agreed to restore formal diplomatic relations in a landmark agreement brokered by China and Iraq in Beijing, ending a seven-year cessation of all formal engagement between the two countries. Although many were skeptical at the time, the start of hostilities in Gaza has brought the two sides into much closer alignment. For example, Saudi Crown Prince Mohammed bin Salman and then-Iranian President Ibrahim Raisi met face-to-face during the joint Arab-Islamic summit on Gaza in Riyadh in November 2023, a little over a month after the start of hostilities in the Palestinian enclave.

Riyadh's stance toward Tehran remains largely anti-escalatory, with Saudi Arabia and other Gulf States fending off Tehran's calls to arm Palestinian groups and cease all diplomatic ties with Israel during the November 2023 summit of the Organization of Islamic Cooperation (OIC) in Riyadh. Since then, Saudi Arabia has regularly called for a ceasefire in Gaza and deescalating tensions between Israel and Iran. "Ultimately, if Israel and/ or the US is going to take military action against Iran, or if Iran is going to be waging more attacks against Israel, like what happened in April, the Saudis want to ensure that they are not a target. Within this context, Saudi Arabia's leadership is determined to keep the détente with Tehran on track," said Mr. Cafiero. "The leadership in Riyadh remembers very well what happened in September 2019 with the Aramco attacks. Saudi officials want to ensure that the Iranians do not see Saudi Arabia as being in any way complicit with American or Israeli aggression against Iran," he added.

Saudi Arabia has also found some common ground with Iran in Africa. In Sudan's ongoing civil war, Riyadh and Tehran both support the Sudanese Armed Forces in different ways. While Riyadh calls for ceasefire talks, Tehran offers direct support in the form of drone exports, furthering its burgeoning global industry and countering the UAE's support for the Rapid Support Forces (RSF) rebel group. With Sudan emerging as a proxy war between Saudi Arabia and the UAE, Tehran's support for the SAF helps balance the war in Riyadh's favor. On August 10, Saudi Arabia also hosted talks between Iranian and Somali diplomats in Jeddah to discuss deepening ties between the two countries. In this way, Riyadh and Tehran have found avenues for win-win cooperation in Africa, albeit through unofficial and unconventional means.

In April 2023, Saudi Finance Minister Mohammed Al-Jadaan stated that Saudi investment in Iran's sanctions-crippled energy sector could happen "very quickly… as long as the terms of any agreement would be respected." Although Riyadh has made no such investments to date, the prospect offers a significant incentive for Tehran to cooperate with Riyadh moving forward.

Saudi Crown Prince Mohammed bin Salman meets with then-Iranian President Ibrahim Raisi on November 11, 2023. Image source

Vision 2030 needs regional stability, as do global markets

Vision 2030's success requires vast sums of cash: since its 2016 inception, the plan's budget has surpassed $1.3 trillion, and the Kingdom aims to attract $3 trillion in total investment by 2030. The plan also carries substantial risk as it relies heavily on the completion of 14 giga projects, the largest of which—NEOM Line City—carried an initial budget of over $500 billion, 50% of Saudi Arabia's entire federal budget for 2024.

According to Bent Flyvbjerg, an economist who has consulted on over 100 billion-dollar-plus projects and collected data on 16,000 others, around 50% of projects at this scale come in on budget, around 9% come in on budget and on time, and less than 1% come in on budget, on time, and deliver their expected benefits. New estimates claim that NEOM's actual cost could reach $1.5 trillion, and expectations have already been scaled back, with the Kingdom recently announcing that by 2030, the project will only be 2.4 kilometers long as opposed to the planned 170 kilometers. In this way, the success of Vision 2030 requires stable cash flow for many years moving forward.

Although Vision 2030 plans to reduce Riyadh's dependence on oil, much of its success hinges on Saudi oil exports, which provide 80% of the country's export revenue and contribute to more than 40% of its GDP. Moreover, oil prices have been falling steadily in recent months on weakening global demand – particularly in the Asian markets – further straining the Kingdom's primary revenue source. In this way, an all-out regional war between Iran, Israel, and potentially the United States – one which could result in the closure of key petroleum export routes in the Persian Gulf and the Red Sea – would be anathema to the Kingdom's grand strategy. "The Saudi leadership's priority right now is making Vision 2030 successful. This requires stability in the Kingdom and stability in the neighborhood," said Mr. Cafiero.

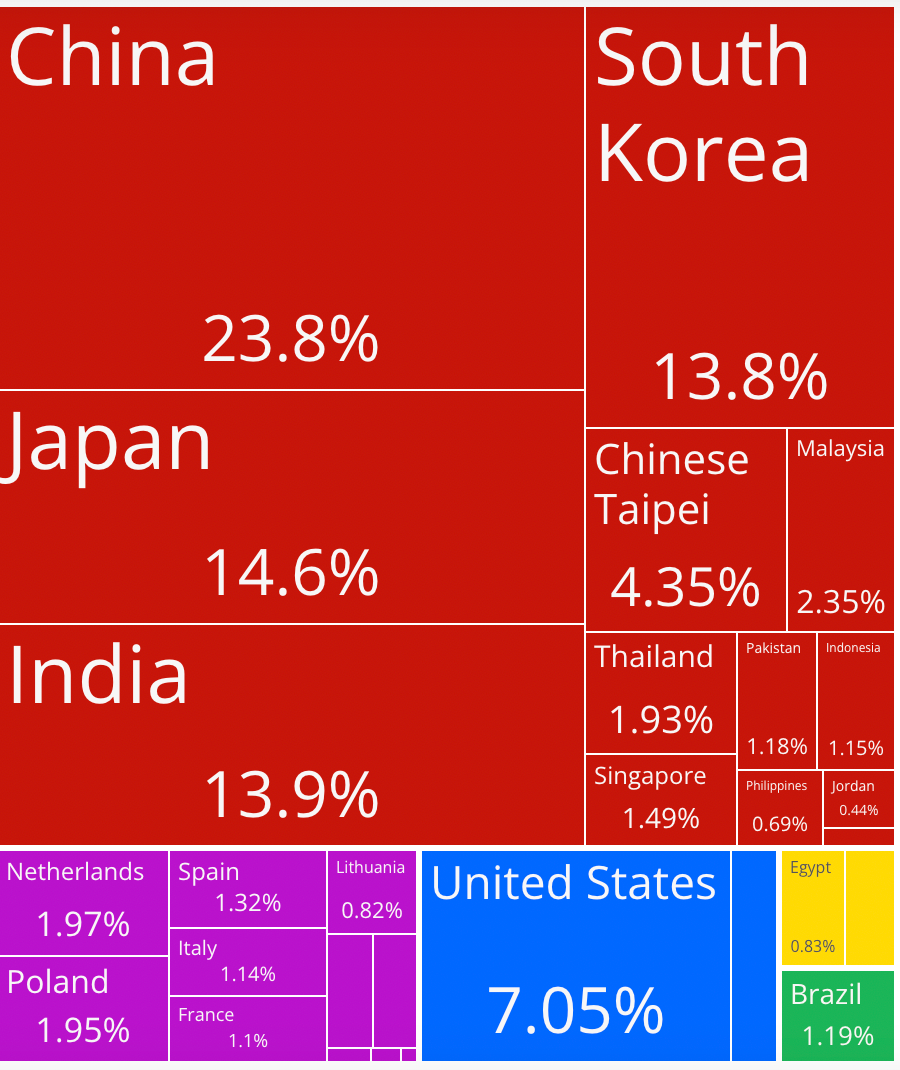

China also fits heavily into this equation. It is the world's single largest buyer of Saudi oil, accounting for nearly 24% of the Saudi crude exports in 2022. The East and South Asian markets accounted for over 79% of Saudi oil exports that year. China also fits heavily into Vision 2030. "There's also a big focus on Chinese tourism," said Mr. Cafiero. This interdependence helps explain last year's China-brokered rapprochement between Saudi Arabia and Iran. It also explains how China and other Asian countries repeatedly join Riyadh in calling for a ceasefire in Gaza and regional de-escalation.

The Asian markets (red) account for the vast majority of Saudi Arabia’s current oil exports. Image source

Conclusion

Taking on a plan as ambitious as Vision 2030 has forced Saudi Arabia into a more balanced and nuanced foreign policy that reflects the country's many interests. Although Riyadh has moved away from the West, this multipolar approach is not without merit for Washington. With tensions with Iran and Israel escalating and Washington possessing limited means to engage Tehran due to its lack of formal relations with the country, Saudi Arabia's continued dialogue with Iran could prove invaluable to an American administration seeking to de-escalate. Moreover, the prospect of Saudi investment in Iran's ailing and sanctions-crippled economy offers much more than dialogue and de-escalation as incentives for Tehran to cooperate in improving regional stability.