Hey everyone,

Here's a newsletter I’ve been following, Money Machine Newsletter. If you want to understand what’s happening in the world, follow the money.

This newsletter is designed to help you become a smarter, independent investor with two things:

Market-beating stocks in a 5-min read. Picked by elite traders. Delivered weekly to your inbox pre-market.

Market, investing, and business insights from insiders and experts outside the mainstream media.

You won’t find the same watered down stock picks like other services. Nor will you find the same regurgitated mainstream media information here.

I’ll let Money Machine Newsletter take it from here…

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

The next $26T wave is approaching.

Today it’s a lab toy. Tomorrow, a $72B shift.

THIS stock is a gas toll empire.

The quiet middle is starting to win BIG.

And more. Let’s get to it!

Top Insights of the Week

1. 🌊 Nothing Stops THIS $26 Trillion Wave

Marc Andreessen just made his boldest bet yet… on humanoid robots.

He says they’ll be bigger than the internet. A $26T industry.

With billions of robots doing real-world work—cleaning homes, building cars, helping doctors.

AI is getting a body… it’s stepping out of the browser and into the real world. Literally. Andreessen calls this “embodied AI.” But the U.S. must move—fast. Marc’s warning? If America doesn’t build these robots first, China will.

China’s already pouring billions into AI + robotics. Their “Made in China 2025” plan is no joke. It includes building millions of robots and controlling the global robot supply chain.

The fear? If the U.S. doesn’t act, we’ll be buying our robots—and our future—from someone else. Marc’s push is simple… Build “alien dreadnought” factories—fully automated production lines. Not old-school assembly. High-tech. Scalable. American-made.

2. 🧠 AI’s Next Brain

Everyone’s glued to AI. Watching it write essays, code, and maybe take your job. But underneath? Same old tech. Same silicon. Same rules. Quantum computing doesn’t play by those rules…

It’s not just “faster.” It’s different. It doesn’t think in 1s and 0s. It thinks in maybes. In probabilities. That opens up problems we couldn’t even touch before.

Let’s zoom out…

Still feels too sci-fi? Here’s what’s actually happening…

IBM, Google, Microsoft are all developing quantum chips.

AWS lets you pay to use a quantum computer online.

What can it change?

Drugs developed in weeks, not years.

Risk models that see around corners.

AI that doesn’t guess—knows.

Shipping routes that make FedEx look clunky.

Here’s what no one is talking about…

China is outspending the U.S. 5 to 1.

U.S. quantum industry today? Still smaller than Dogecoin. Think “buying Bitcoin at $500” early.

Estimated 840,000 jobs coming by 2035.

Governments aren’t treating this like science class. They’re treating it like oil.

3. ⛽️ A Gas Toll Empire

Most energy companies gamble on oil prices. Cheniere (NYSE: LNG) doesn’t. They don’t drill. They don’t speculate. They ship liquefied natural gas (LNG) across oceans — and get paid like clockwork…

Cheniere runs the biggest LNG export terminals in the U.S. Think toll roads for gas. Every molecule that passes through? They clip the ticket.

And the best part? 90% of sales are locked in with long-term contracts — 15 to 20 years — with giants like BASF and Equinor. That means steady cash, even if prices swing.

LNG demand is soaring — up 26.8% a year through 2033. Asia and Europe can’t build fast enough. And 20% of U.S. exports? Cheniere handles them.

Big things are coming… Corpus Christi Stage 3 goes live soon… Sabine Pass expansion is next… That’s 30M+ tonnes of extra capacity.

$5.4B revenue (up 28%)

$1.9B EBITDA

$1.3B in free cash flow

$350M in buybacks

$0.50 dividend

Yes, there’s $27B in debt. But they’re managing it — paying it down and refinancing.

Risks…

Global supply glut

EPA regulation

Two megaprojects at once (Corpus Christi Stage 3 and Sabine Pass expansion)

Debt always needs watching

Top 3 Charts of the Week

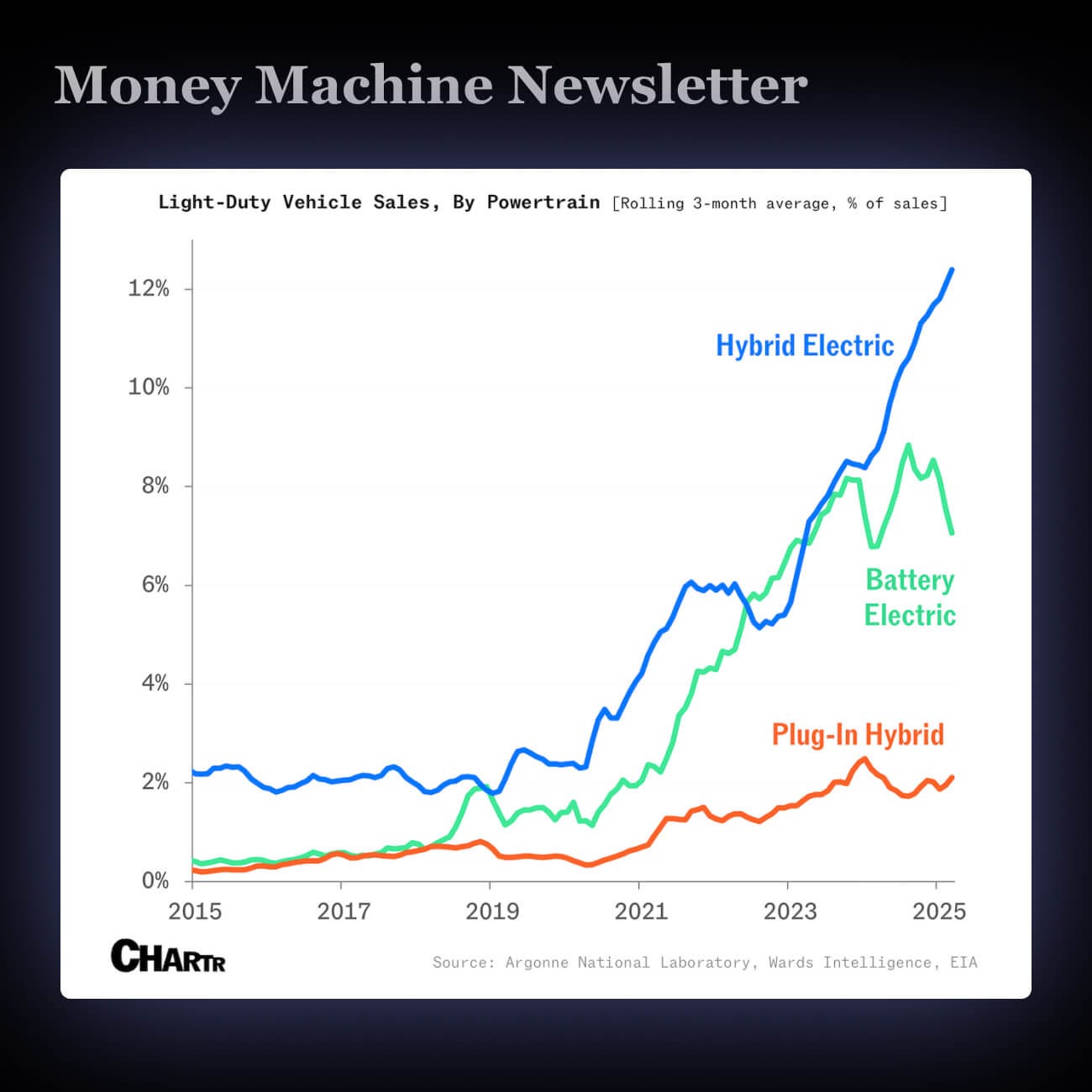

1. 😳 Hybrid Sales Hit New Highs

1 in 8 cars sold in the U.S. is now a hybrid. That’s more than full-electric cars, which are losing steam. Toyota’s bet on hybrids is paying off.

EV hype is cooling. Only 7.1% of new cars are fully electric. Hybrids are quietly winning — they’re cheaper, simpler, and fit how most people actually drive.

Gas cars still dominate in the U.S.—78% of all sales. Tesla is losing steam, with Q1 sales down 13% to 336,681 cars. Meanwhile, Toyota stays on top, selling 10.8M cars last year. Just 1% were fully electric, 40% were hybrids.

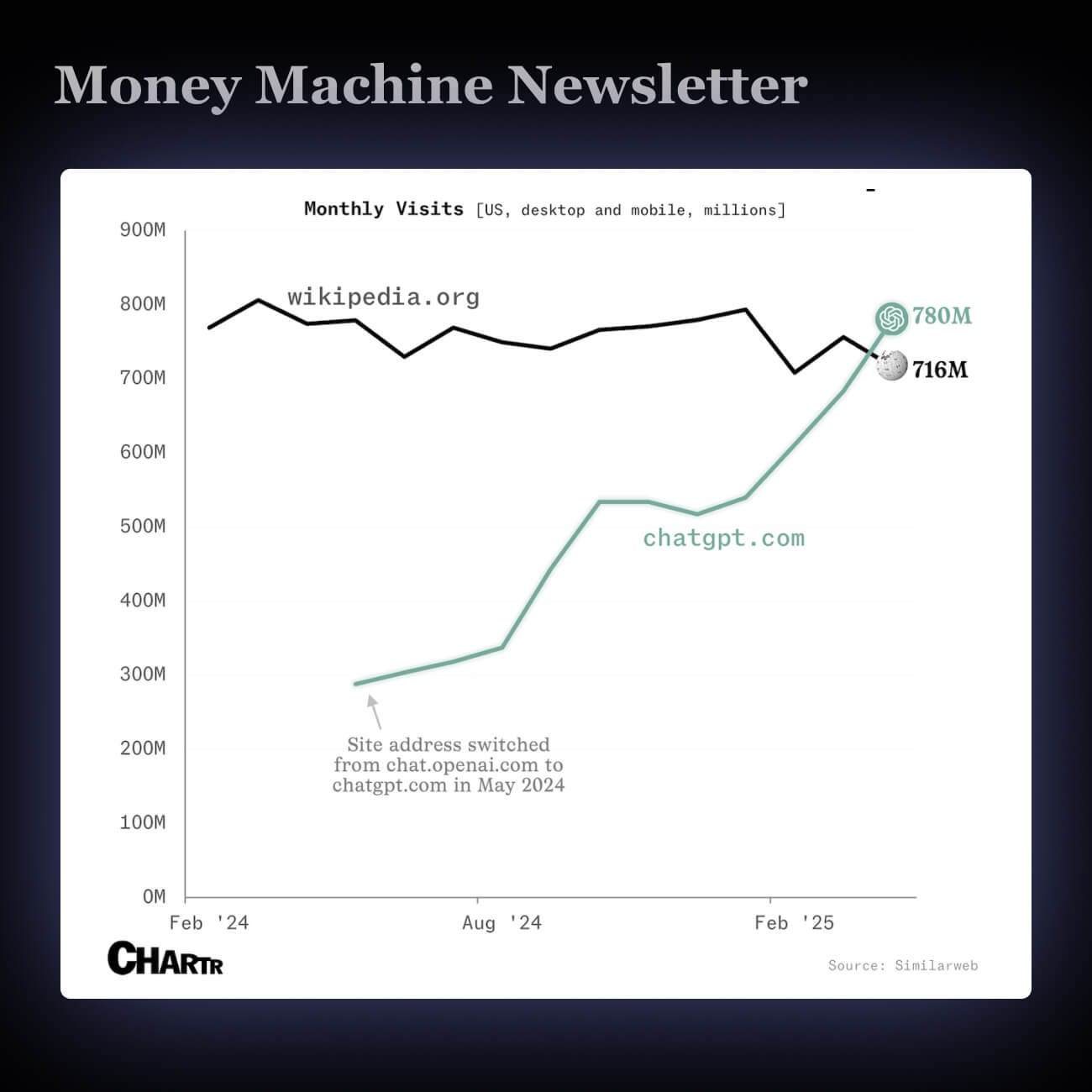

2. 📈 ChatGPT Traffic Has Overtaken Wikipedia

ChatGPT just passed Wikipedia in U.S. web traffic, hitting 780M (according to Similarweb) visits in April — a 14% jump from March. Americans are visiting ChatGPT about 14 times each on average.

People aren’t just trying ChatGPT — they’re sticking around. It's becoming the go-to place for quick answers, even more than Wikipedia.

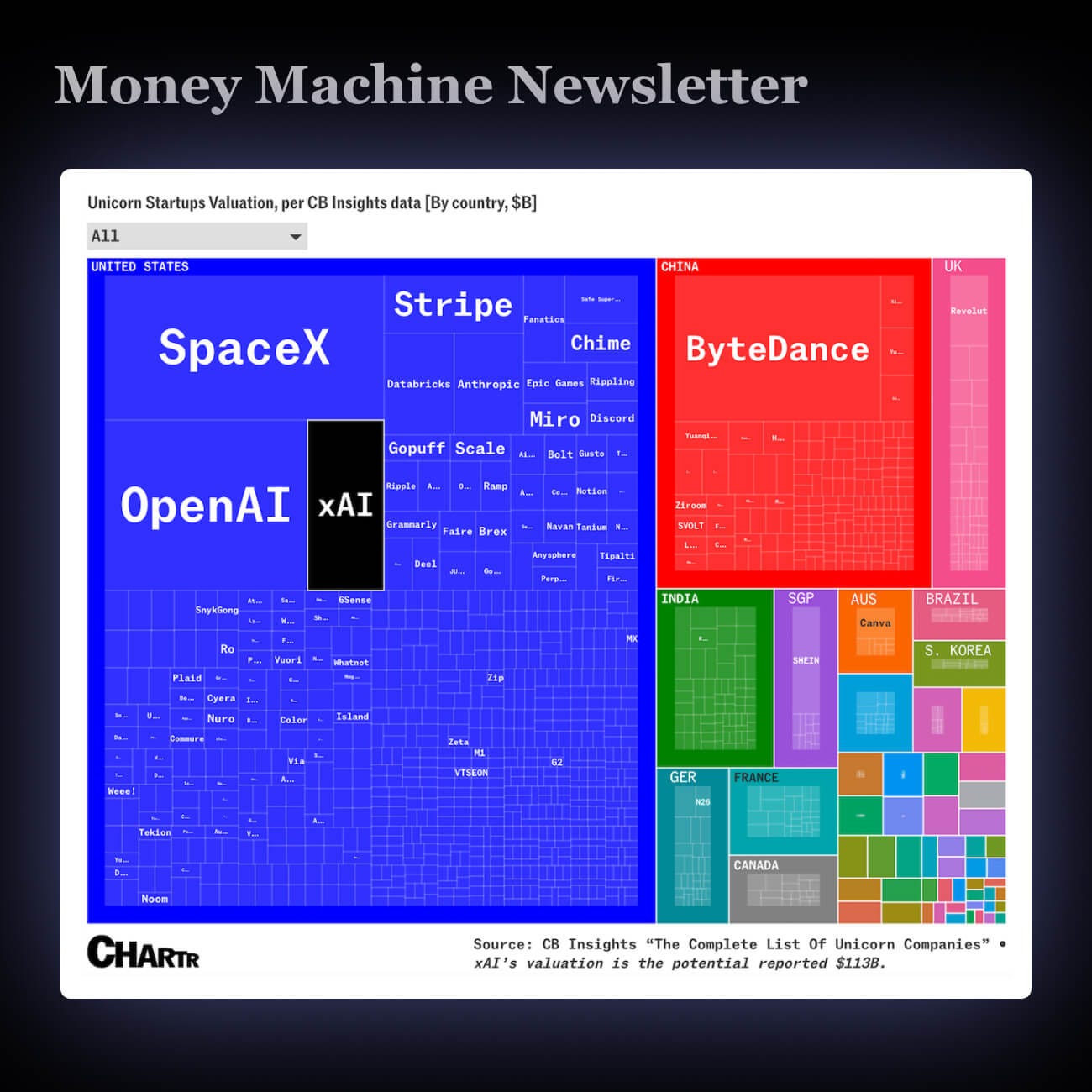

3. 💰 The World's Most Valuable Startups

Startups worth $1B used to be rare. Now there are over 1,283 unicorns, with 705 in the U.S. Elon Musk’s AI company, xAI, just joined the $100B+ “hectocorn” club.

The bar keeps rising. Unicorns are normal now. Investors are chasing even bigger bets. xAI is only 2 years old, yet it’s already worth $113B, making it the 4th biggest startup on Earth.

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with Money Machine Newsletter’s trade ideas.

Subscribe to Money Machine Newsletter

Hundreds of paid subscribers

Market-beating stocks in a 5-min read. Picked by elite traders. Delivered every Monday to your inbox before the market opens.

See you in there!

Best,

Money Machine Newsletter

Nothing in this email is intended to serve as financial advice. Do your own research.