China’s Gray Zone Syndicates – Part III: Blowback and Breakdown

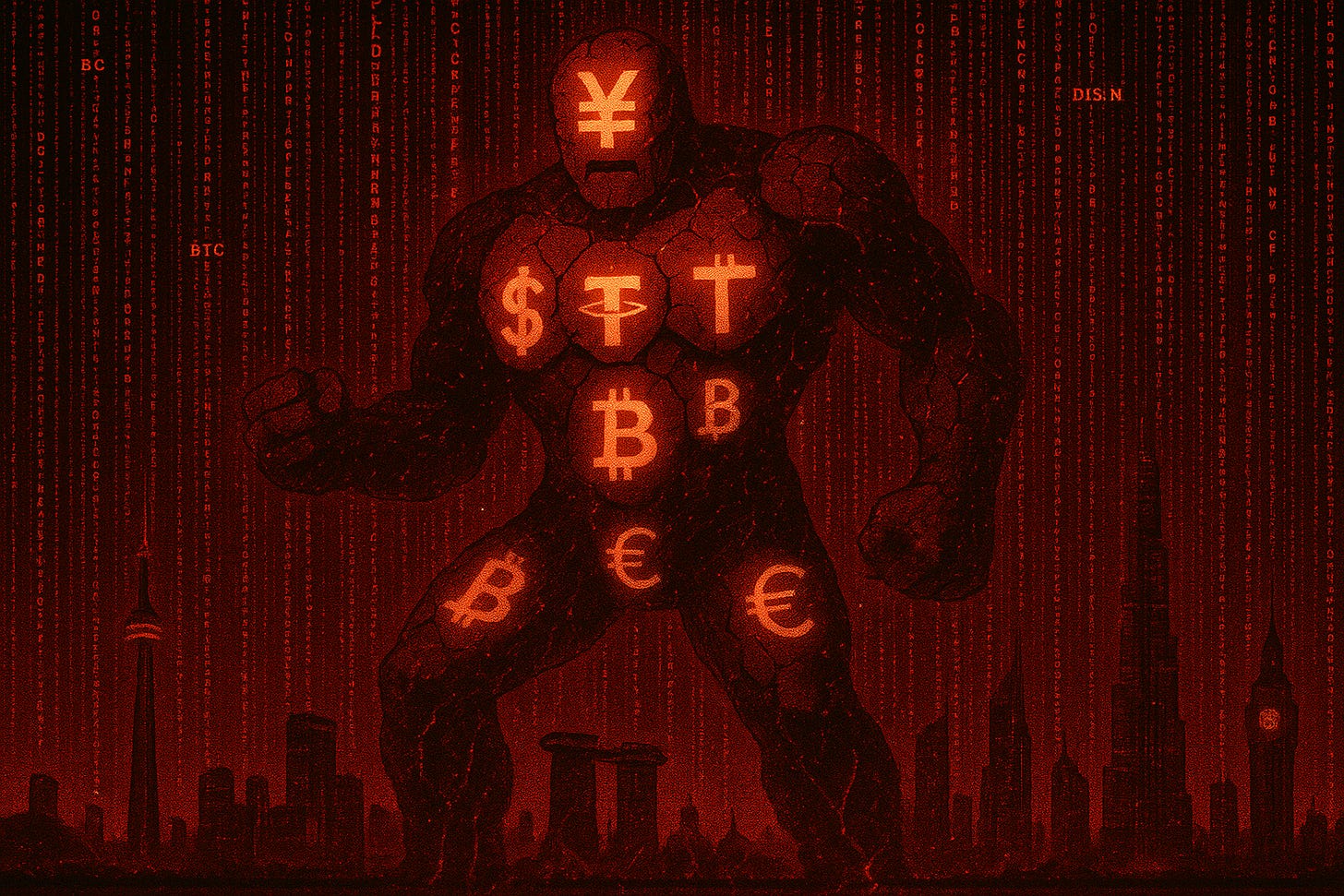

How China’s Shadow Architecture Turned Against It and the World—and What Comes Next

In the first two parts of this series, we examined how Beijing has strategically blurred the lines between crime, finance, and statecraft.

Part I explored how transnational criminal networks—scam syndicates, money laundering fronts, and trafficking hubs—offered China a deniable infrastructure for advancing influence across Southeast Asia and beyond.

Part II explored how informal financial channels—ranging from offshore dollar reserves and state-tied shell companies to elite capital flight—became embedded in China’s strategy for resilience, evasion, and quiet geopolitical reach.

But the system has started to turn on its architects.

What began as a tool of resilience has become a vector of global risk. China’s shadow reserves, gray banking operations, and offshore laundering proxies—once seen as clever circumventions of Western sanctions—are now leaking influence, bleeding capital, and empowering actors Beijing can’t fully control. In some cases, these networks pose greater strategic and reputational threats than the constraints they were built to avoid.

Think the Chernobyl disaster—but global. A radioactive core leaking financial and geopolitical fallout across everything it touches, until someone builds a concrete dome over the whole thing. That dome may be coming—but the damage is already done, and the fallout will linger for years.

This third and final installment unpacks how the very mechanisms China built to escape constraint may now be generating volatility, corruption, and strategic backlash at a scale even Beijing can’t contain.

The Internal Fracture: Power Diffusion at Home

When Beijing implemented the Three Red Lines policy in 2020 to curb reckless real estate borrowing, it triggered a cascade far beyond the housing sector. As liquidity dried up, elite families and state-linked firms sought refuge—not in domestic reforms, but in the exit ramps of offshore finance. A surge of capital flight followed, channeled through underground banks, crypto rails, and shell networks tied to party patrons abroad.

But this wasn’t a system constructed from scratch—it was already primed for abuse.

For years, state-owned banks had been quietly stockpiling offshore dollar reserves, tucked away in opaque accounts and affiliated investment vehicles. These reserves, originally meant as a financial shock absorber against Western pressure, became a deep pool of shadow liquidity—ready to be tapped, siphoned, or strategically rerouted with minimal oversight.

What began as a strategy for resilience—steering capital into the shadows to protect it from volatility—has become a mechanism for fragmentation.